Merkle: After big increases in mobile inventory last year, paid search growth slows a bit in Q3

Still, mobile spend increased significantly year over year, and Google product listing ads continue to drive growth.

Overall, spend growth on paid search dipped in Q3 to 14 percent year over year, down from 15 percent growth seen the previous quarter, according to Merkle’s Q3 Digital Marketing Report, issued this week.

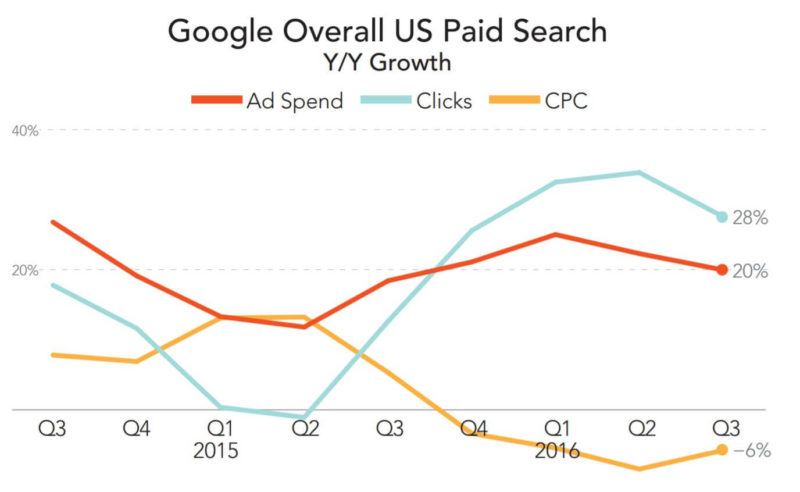

Merkle says the slowdown was expected when comparing to the period last year, when Google significantly increased the number of ads displaying on mobile search results. Click volume growth slowed in Q3 to 20 percent year over year. Click growth has been trending down the past two quarters after dramatic increases seen in the last two quarters of 2015. Overall, CPCs were off five percent from last year.

Mobile spend across the search engines increased by 134 percent year over year. Meanwhile, search spend on desktop and tablet spend dipped four percent.

Google accounted for 86 percent of ad spend and 87 percent of click volume among Merkle clients represented in the report. That’s up from 81 percent and 82 percent a year ago, respectively.

On AdWords, spend and click volume growth both slowed in Q2. Spend increased 20 percent year over year in Q3 2016. Click volume growth slowed to 28 percent and could have slowed further if not for more traffic being driven by product listing ads on search partner sites, the addition of a fourth text ad in many mobile search results and the expansion of local search ads at the end of Q2, says Merkle.

Ads on Google Maps drove about three percent of mobile clicks on brand searches for advertisers with physical locations at a higher than average CPC.

Combined, tablets and phones drove 62 percent of Google AdWords clicks, up five percent from Q2. Overall, CPCs fell six percent year over year.

Product Listing Ads

Google product listing ads continue to be an increasingly important ad format for retail. Google product listing ads (PLA) accounted for 48 percent of retailers’ search ad clicks from Google in Q3. And, PLAs’ share of non-brand clicks among retailers reached 73 percent.

PLA spend rose 36 percent year over year, down from 43 percent spend growth last quarter. Clicks increased 59 percent, growing nearly six times faster than text ads, which saw click volume increase nine percent year over year in Q3.

PLA growth came in part to the addition of PLAs in image search, as well as from Yahoo serving PLAs from Google on its search results. Across search partners, PLA click volume increased by 23 percent, compared to just nine percent growth on Google.com.

Expanded Text Ads

Merkle says the data show “benefits of the format have been minor” in regard to click-through rates so far. Merkle has seen below-average CTRs for ETAs on brand terms and mixed results for non-brand ads at the top of the page.

Spending on text ads rose nine percent year over year on 11 percent growth in click volume.

Google Display Network

The GDN accounted for eight percent of advertisers’ spend on Google in Q3, which is a slight dip from nine percent a year ago. Still, Merkle says, about half of advertisers included in the report increased GDN spend share from a year ago.

Mobile made up 30 percent of spend on the GDN, up from 24 percent in Q3 2015.

Bing and Yahoo

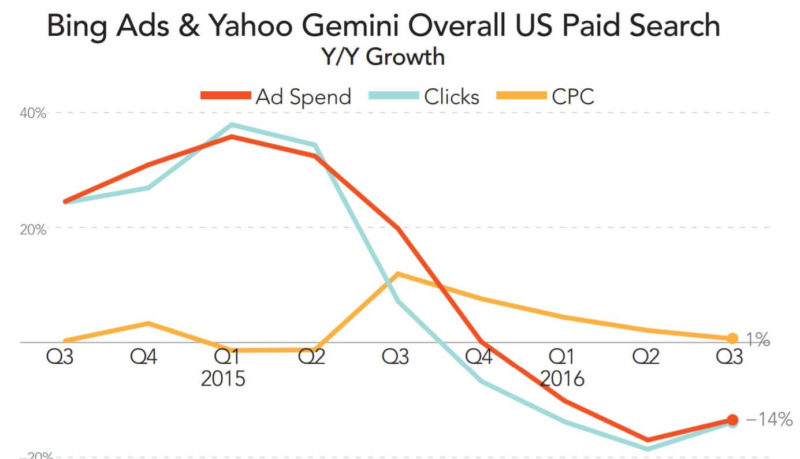

Combined, Bing Ads and Yahoo Gemini spend growth fell 14 percent year over year. However, that was less than the 17-percent decline seen in Q2, however, and the first improvement seen in the past six quarters, according to Merkle. Merkle attributes the declining click growth in part to the fading influence of Yahoo’s deal to become the default search engine for Firefox and Bing’s initial ramping up of Product Ads in 2014.

Among Merkle’s client set, Bing product ads are not seeing the level of success achieved by Google product listing ads. Bing product ad spend fell 12 percent year over year in Q3. Growth began slowing early this year, as Yahoo appeared to be serving Google PLAs instead of Bing product ads on many search results.

Gemini’s click volume share across Yahoo and Bing has held relatively steady (17 percent in Q3 2016) since October 2015, “suggesting that there has been little movement in the past year to further ramp up volume from the Gemini platform for established participants,” says Merkle.

Even with a four-point increase in phone click share from Q2 to Q3, mobile continues to be a challenge for Bing Ads. Just 15 percent of Bing Ads clicks came from phones, compared to 49 percent for Google and 26 percent for Yahoo.

The full report includes data on organic and social trends, as well as more paid search detail. It’s available for download here (requires registration).